As the tax deadline (April 30th, 2014) is rapidly approaching, the time has definitely come for you to decide which option you will be going with: filing your own or hiring an accountant.

To help you decide on the best route, let’s examine the pros and cons of both scenarios.

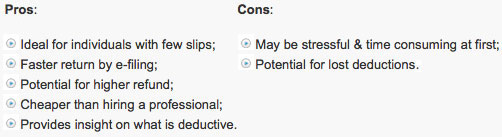

Filing Your Own Taxes

Particularly ideal for individuals with not many tax slips, this is the option that presents the opportunity to overwhelm many individuals. For those of you who have never done so, there is definitely nothing to be afraid of, especially since if you happen to miss something, you can always declare it the next year.

Though hard copies of tax forms are available for mailing, it is advisable that those considering filing their own taxes, do so with a tax software. Not only does the use of software guarantee a faster return, but it also heightens accuracy and potentially a bigger refund, especially for those new to the tax filing world. In fact, an experiment was carried out by MyWifeQuitHerJob, where taxes were calculated both with the help of tax software and a professional. Turns out that the accountant missed a couple of deductions and even made a typo, leading the couple to having calculated a higher refund on their own. While this may have been a fluke, it most certainly doesn’t mean that this might happen to you, mistakes do happen even in the accounting world, and it’s definitely a reality not to take lightly.

As for the tax software at your disposal, we suggest taking a look at our store pages for HR Block and TurboTax as we have VoucherCodes.ca Exclusive coupon codes (meaning they’re not available anywhere else!) available for both.

In fact, a survey found that Canadians who filed their own taxes spent 60% less than those who paid for an accountant — shockingly convincing data isn’t it?

Filing your own taxes will also give you more in-depth knowledge into the world of taxes and most importantly, into your own finances. Seeing all the numbers of where the money has been going might be convincing enough for you to set up an RSP.

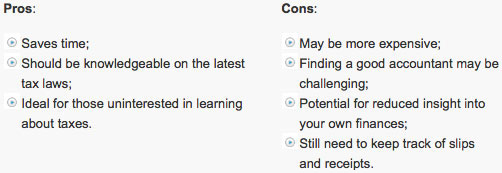

Hiring an Accountant

The general rule of thumb is that if your taxes are complicated and require itemization, then the accountant route is probably for you. Basically, for those who are investors, property owners, self-employed, or who have received inheritance, it is advisable to hire an accountant.

Before hiring an professional however, it is important to do your research in determining the best one for your needs, especially since an increasing number of accountants: “look below the surface to see what helps business owners, or what’s causing their business not to do well”.

Finding the best professional is also important because if you find a place that isn’t as reputable, then it will be your responsibility regardless as at the end of the day, they’re your returns. Informing yourself is also imperative, especially with regards to fees as, “discounters can take no more than 15 per cent on the first $300 of the refund and five per cent after that” — all staggering numbers, especially if you only have a couple of tax slips.

Bottom-Line

In the end, if you’re not so good with numbers or you own a business, property and anything else that might require additional knowledge and foresight, then it is recommended that you seek the advice and help of a professional.

As for individuals with a couple of tax slips, then using tax software may just yield a higher return and increased peace of mind.

Whichever option you have decided to go with, always double-check all of the results because as we’ve mentioned before, mistakes can happen and typos are inevitably performed even by professionals.

Edit: Originally published on: Apr 24, 2013 @ 7:13. Updated to keep content fresh.